General Discussion

Digital Magazine

Digital Magazine

Extra Fine Milling Katana STML

Digital Magazine

Dentsply Sirona World 2021

Digital Magazine

Staged Transcrestal Sinus Lift: An Alternative Approach

Digital Magazine

What Lies Beneath the Surface?

Digital Magazine

The Y’s of Zirconia

Digital Magazine

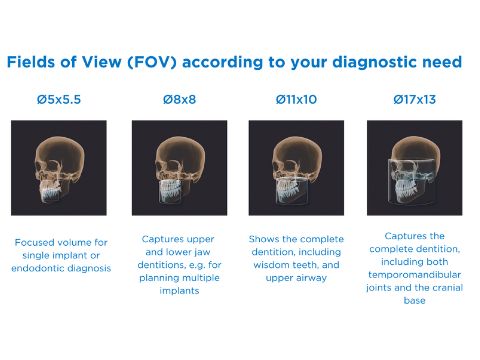

Axeos: Favored by Dentists, Loved by Patients

Digital Magazine

Copy And Mirror Is Ideal For Single Centrals

Digital Magazine

CERASMART® 270 and G-CEM ONE™- A Winning Combination

Digital Magazine

Why I Use LendingClub Patient Solutions

Announcements and Feedback

Dentsply Sirona World is BACK in Las Vegas!

Digital Magazine

By Sean Clark-Weis

By Sean Clark-Weis

By Mike Skramstad

By Mike Skramstad

By CDOCS Staff

By CDOCS Staff

By Farhad Boltchi, D.M.D.

By Farhad Boltchi, D.M.D.

By Karyn Halpern

By Karyn Halpern

By Meena Barsoum

By Meena Barsoum

By Anthony Ramirez

By Anthony Ramirez